C/O Kenya School of Monetary Studies

NAIROBI - KENYA.

-

Eight States benefit from macroeconomic analysis training

- February 16, 2024

- Posted by: Willis Osemo

- Category: Latest News

No Comments

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test.

-

COMESA and Its Institutions Hold 2nd CEO’s Retreat

- April 23, 2023

- Posted by: Willis Osemo

- Category: Latest News

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test.

-

Digital Finance has Thrived in COMESA Region During COVID-19 Pandemic

- March 2, 2023

- Posted by: Willis Osemo

- Category: Latest News

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test.

-

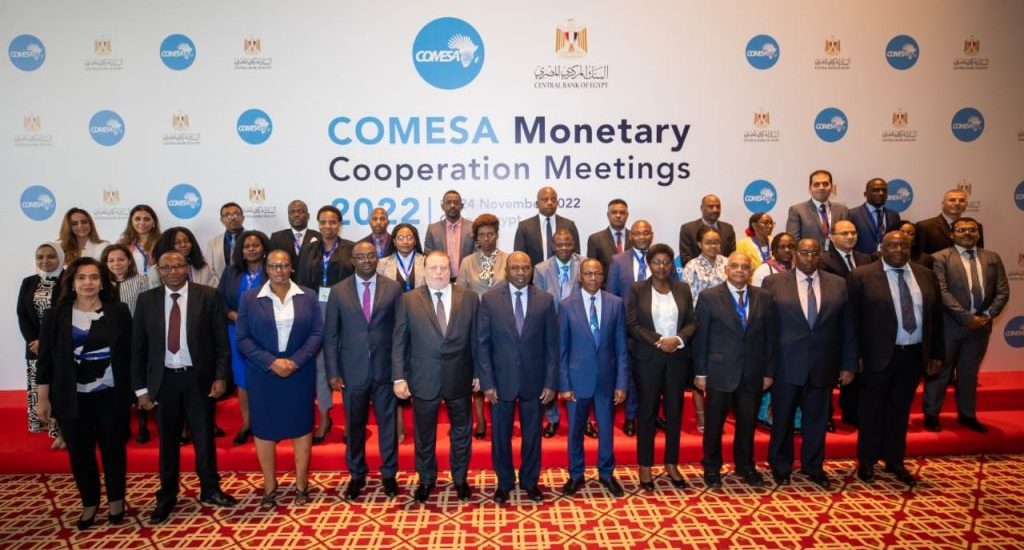

COMESA Governors of Central Banks Meet in Egypt

- December 2, 2022

- Posted by: Willis Osemo

- Category: Latest News

Bring to the table win-win survival strategies to ensure proactive domination.

-

Coming Soon: COMESA Financial Stability Report

- July 6, 2022

- Posted by: Willis Osemo

- Category: Latest News

At the end of the day, going forward, a new normal that has evolved from generation.

-

COMESA Calls on Member States to Utilise Online Payment Platform, REPSS

- March 27, 2022

- Posted by: Willis Osemo

- Category: Latest News

User generated content in real-time will have multiple touchpoints for offshoring.